is a tax refund considered income for unemployment

So you may have a refund coming though only if your adjusted gross income total income minus a few deductions was under 150000. Include net self-employment income you expect what youll make from your business minus business expenses.

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

It could be a difficult tax year for some people who.

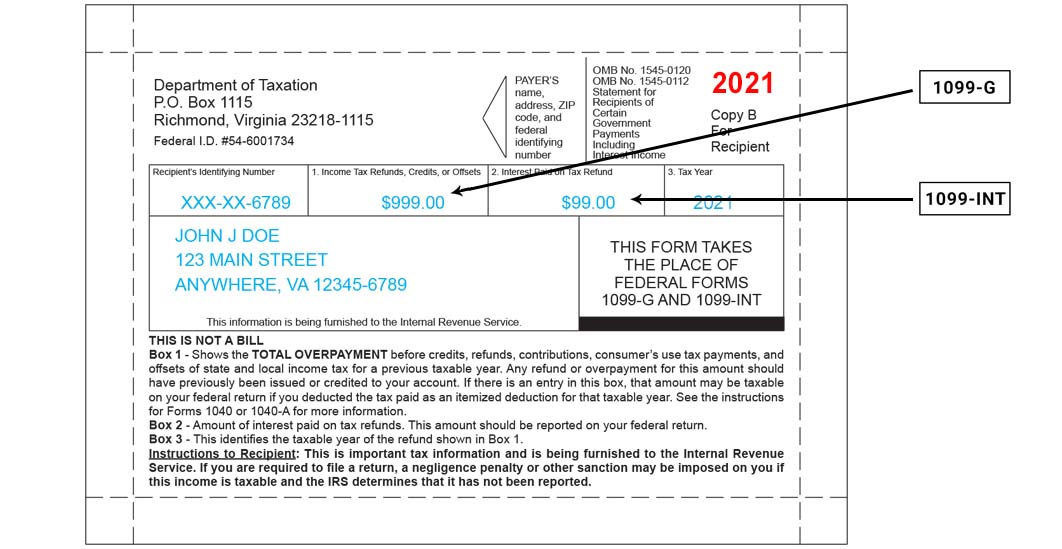

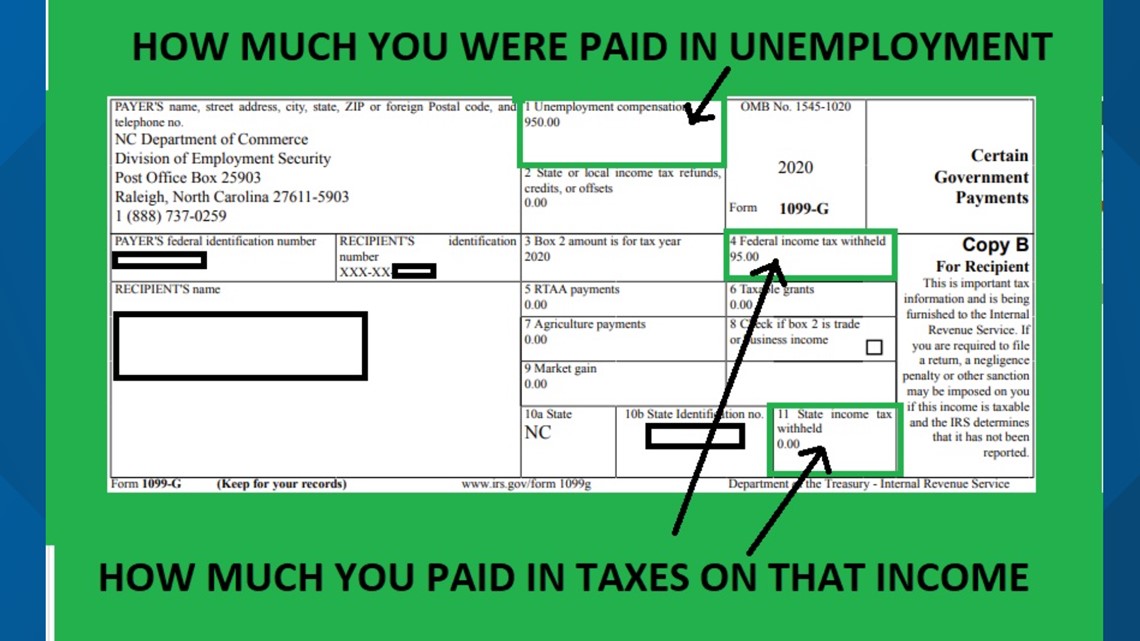

. IR-2021-212 November 1 2021. Youll be asked to describe the. If you receive unemployment benefits during a tax year you will receive a 1099-G form.

This may help reduce your overall tax burden in the year you claim them. Since a composite return is a combination of various individuals. Unemployment income is considered taxable income and must be reported on your tax return.

The supplemental income tax is not in addition to standard income tax rates. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. If the amount of advance credit payments you get for the year is less than the tax credit you should have received youll get the difference as a tax credit when you file your federal income.

Unemployment Payments Are Considered Taxable Income by the IRS. The State of New Jersey offers some retirement income exclusions you may qualify to use that. A large tax refund will not affect your unemployment benefits.

The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. The federal supplemental withholding tax is 22. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

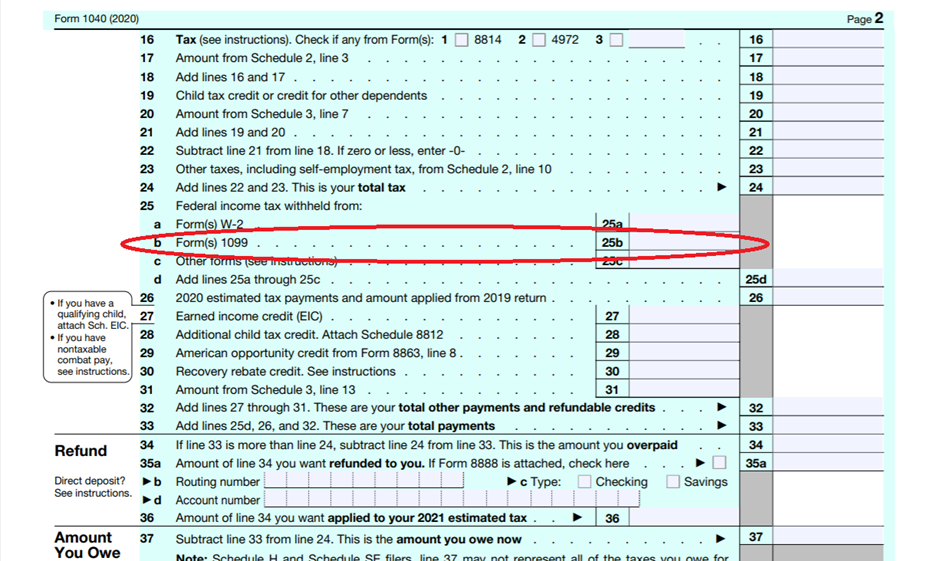

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Income Tax Refund Information. Federal Income Tax.

Instead you use the supplemental rate in place of the standard. These are considered regular income and youll get a W-2. In fact unemployed people often receive a larger than usual income tax refund as the payroll department.

To report unemployment compensation on your 2021 tax return. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Unemployment benefits arent subject to Medicare or Social Security taxes only to income tax.

New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. You worked hard during your career to provide income through your retirement. It is included in your taxable income for the tax year.

Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160.

Tax Refunds Coming To Some Folks Who Got Unemployment Benefits Kokh

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Issues More Tax Refunds Relating To Jobless Benefits

Unemployment Are Benefits Taxed Income Fingerlakes1 Com

Guide To Unemployment And Taxes Turbotax Tax Tips Videos

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund San Tan Valley News Info Santanvalley Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

Some May Receive Extra Irs Tax Refund For Unemployment

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Is Unemployment Taxed H R Block

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

2021 Unemployment Benefits Taxable On Federal Returns King5 Com